tn franchise and excise tax guide

Tennessee franchise tax due date 2022. Tennessee Franchise and Excise Tax Guide October 2020.

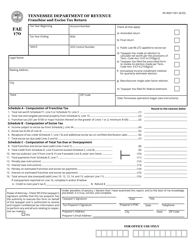

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the Secretary of State to do business.

. FE Credit-2 - Broadband Internet Access Credit Repealed. Click on the fillable fields and put the requested details. Net taxable income starts with federal taxable income and certain adjustments are applied to arrive at net taxable income for Tennessee purposes.

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee. Tennessee franchise tax due date. Franchise and Excise Taxes 1 Dear Tennessee Taxpayer This franchise and excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee franchise and excise tax requirements.

There are some exemptions to filing franchise and excise tax. Racist guide to south africa Todays world is filled with technologies chemistry projects social projects but nonetheless now we have been following a thought of their stage or dais. Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an estimated payment is deficient or delinquent up to a maximum of 24 of the deficient or delinquent amount.

Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. 123456789 New account format. At that time drama was performed only morning.

The only changes are happened genuinely. Tennessee franchise tax 2021. Proprietorships are not subject to these taxes.

Form FAE170 Franchise and Excise Tax Return includes Schedules A-H J K M N-P R-V. Franchise and Excise Taxes Dear Tennessee Taxpayer This franchise and excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee franchise and excise tax requirements. It is not an all- inclusive document or a substitute for Tennessee franchise and.

For more information view the topics below. Tennessee franchise and excise tax guide. The minimum tax is 100.

5 Page Estimated Tax Payments 100. The excise tax is based on net earnings or income for the tax year. The opinions expressed in the manuals are informal and do not constitute a revenue or letter ruling pursuant to the provisions of Tennessee Code Annotated 67-1-109.

The excise tax is 65 of the net taxable income. Tennessee franchise tax payment. The information provided in the Departments tax manuals is general in nature.

Look through the recommendations to find out which info you will need to provide. Tennessee franchise and excise tax manual. A continuation of discussion on the various exemptions available under Tennessee Franchise and Excise tax law.

Franchise Excise Tax - Franchise Tax. Corporation Limited Liability Company Limited Partnership - not financial institution or captive REIT Form FAE170 Schedules and Instructions - For tax years beginning on or after 1121. Excise tax 65 of Tennessee taxable income.

Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an estimated payment is deficient or delinquent up to a maximum of 24 of the deficient or delinquent amount. Franchise and Excise Tax Returns. This franchise excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee franchise excise tax requirements.

FE Credit-4 - Gross Premiums Tax Credit. Important Notice 13-16 Single Member LLCs. It is not an all- inclusive document or a substitute for Tennessee franchise and excise tax statutes or rules and regulations.

All franchise and excise returns and associated payments must be submitted electronically. Select the form you need in our library of legal forms. Tennessee franchise tax form.

The excerpts from the Tennessee Code are through the 2020 legislative session. Install the signnow application on your ios device. Yourself with how these taxes apply to you.

These entities that are subject to the franchise or excise tax must file their own separate franchise and excise tax return. It is not an all-inclusive document. The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property.

Open the form in the online editor. Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting. FE Credit-5 - The Excise Tax Credit for an Entity that is Subject to the Hall.

If you had a franchise excise tax account number before May 28 2018 the only change to this number is the addition a zero to the beginning of the number. The tax guide is not intended as a substitute for Tennessee franchise excise statutes or Rules. Wwwtngovrevenue under Tax Resources.

Who is exempt from franchise and excise tax in Tennessee. Tax Classification Important Notice 14-12 Single Member LLC Subsidiaries of REITS. Tennessee franchise and excise tax guide tenn.

The franchise tax is an asset based tax on the greater of net worth of the company or the book value of real and tangible personal property owned or used in Tennessee at the end of the taxable period. The excise tax is based on the net income of the company for the tax year. For example certain limited liability companies limited partnerships and limited liability partnerships whose activities are at least 66 farming or holding personal residences where one or more of its partners or members reside are exempt.

Tennessee franchise tax due date 2021. Electronic Filing and Payment. FE Credit-3 - Brownfield Property Tax Credit.

The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. FE Credit-1 - Tax Credits are Claimed by the Entity That Earned Them. Their drama was performed in open air now its within the covered area.

It is calculated from the due date of the estimated.

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms

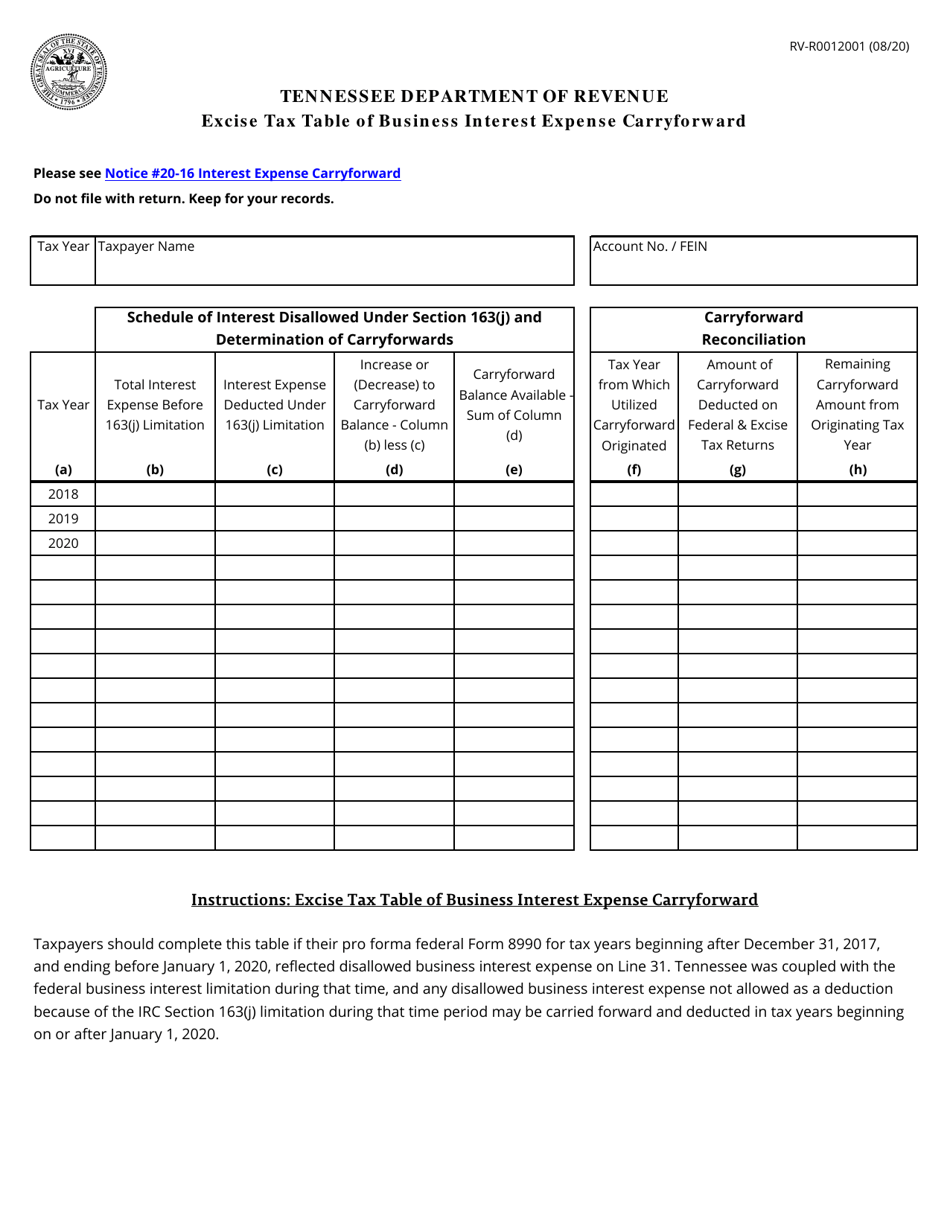

Form Rv R0012001 Download Printable Pdf Or Fill Online Excise Tax Table Of Business Interest Expense Carryforward Tennessee Templateroller

Get And Sign Tennessee Franchise And Excise Tax Form 2017 2022

Fillable Online Tennessee Tennessee Department Of Revenue Franchise And Excise Tax Tennessee Fax Email Print Pdffiller

Franchise Excise Tax Consolidated Net Worth Election Applicaion Youtube

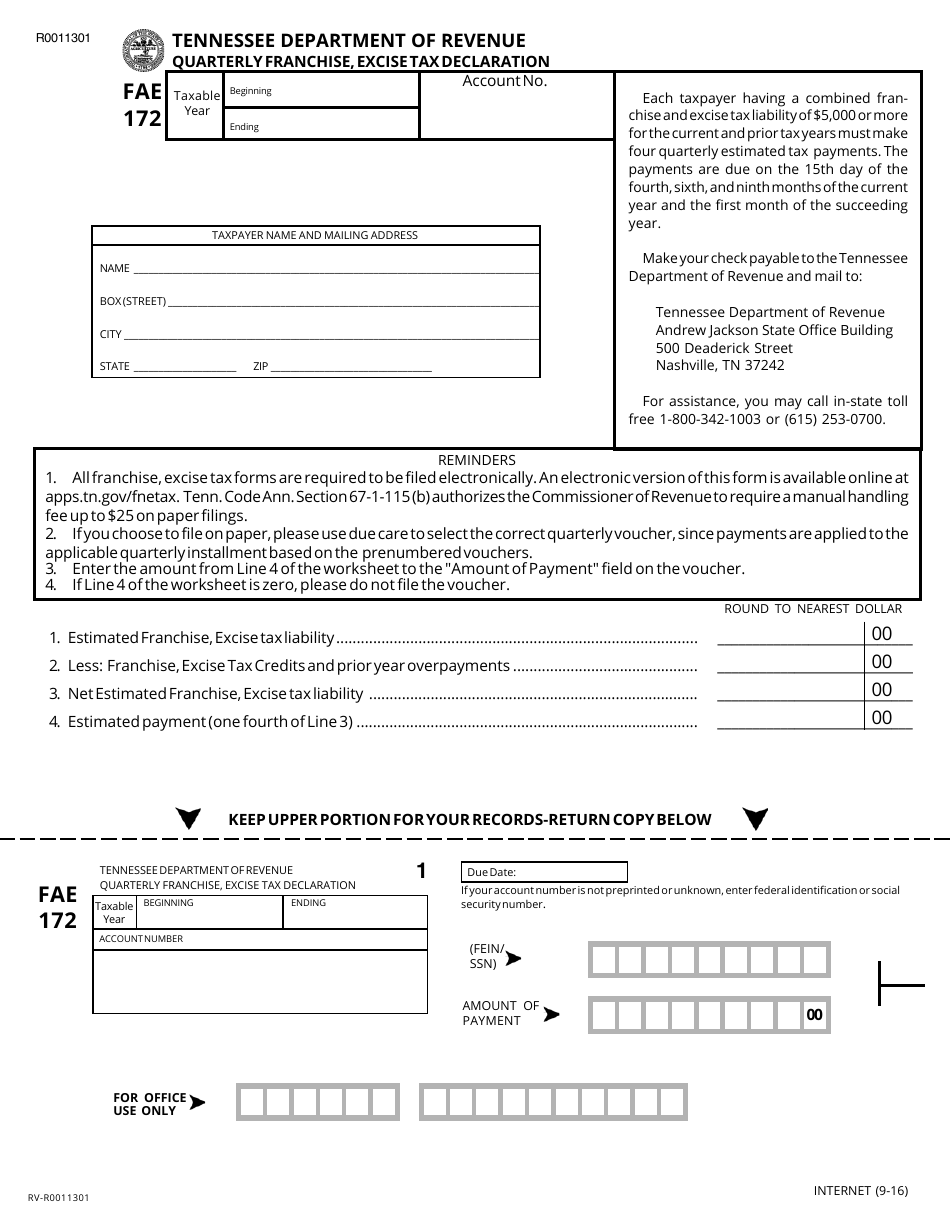

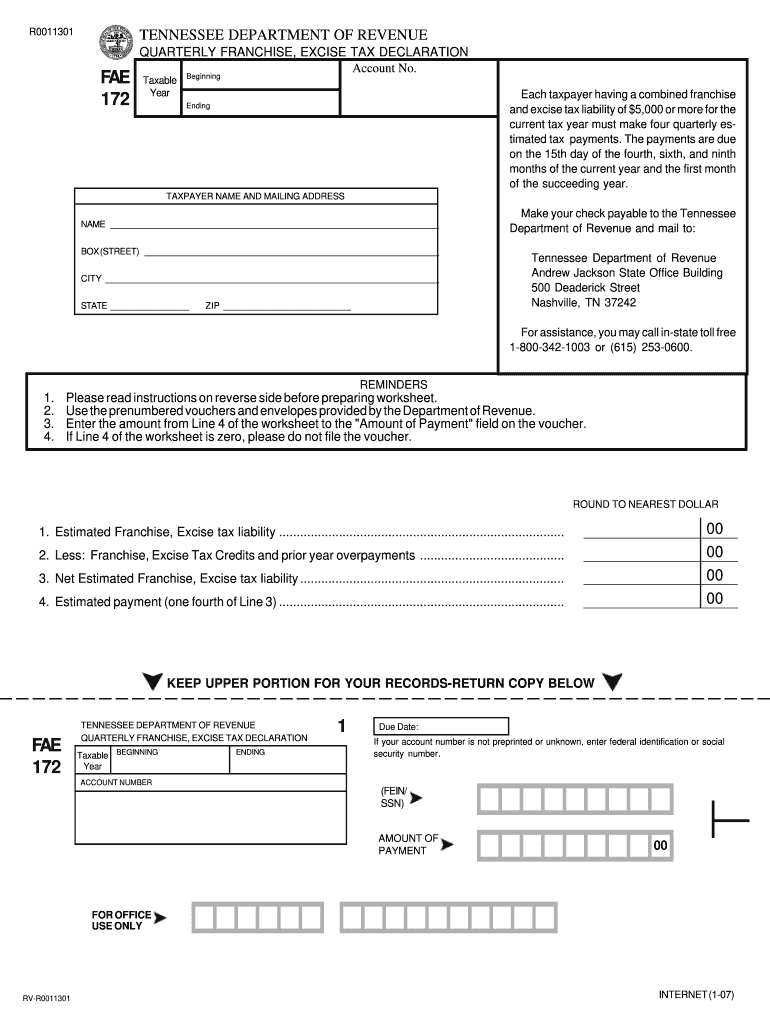

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration 2016 Templateroller

Tennessee Franchise Excise Tax Price Cpas

Fillable Online State Tn Tennessee Tax Franchise Excise Federal Income Revision Form Fax Email Print Pdffiller

Does Partnerships Pay Excise Taxes In Tennessee Ictsd Org

2021 Form Tn Dor Fae 183 Fill Online Printable Fillable Blank Pdffiller

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Tn Fae 170 Instructions 2020 Fill Online Printable Fillable Blank Pdffiller

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

2017 2022 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank Pdffiller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas